If you file your return after the due date you will have to pay interest under Section 234A 1 per month or part month on the unpaid tax amount. Click on Continue to pay through the required payment gateway.

Pf Payment Due Date For April 2020 Youtube

It shall be reduced to Rs 1000 if the total income is less than Rs 5 lakh.

. PAN of the Payee if Available. The government will inject Rs 50000 crores of liquidity by lowering TDS prices for non-salaried specified payments rendered to citizens and TCS rates for specified receipts by 25 of the current rates. For an employer to make the EPF online payment they must be registered under the PF Act.

This should be done on or before the 15th of every next month. Payment and filing due dates for PF ESI and TDS. The interest rate on PF deposits was 85 per cent in the previous financial year.

EPF payment due date is the date by which PF from the employees salary should be deducted. Employees provident fund EPF interest rate was cut to a four-decade low of 81 per cent for the 2021-22 fiscal. Due dates of depositing TDS deducted Yashesh Ashar Partner Bhuta Shah Co LLP a chartered accountancy firm says As per section 200 of the Income-tax Act 1961 the deductor of the tax is required to deposit the TDS to the government with the.

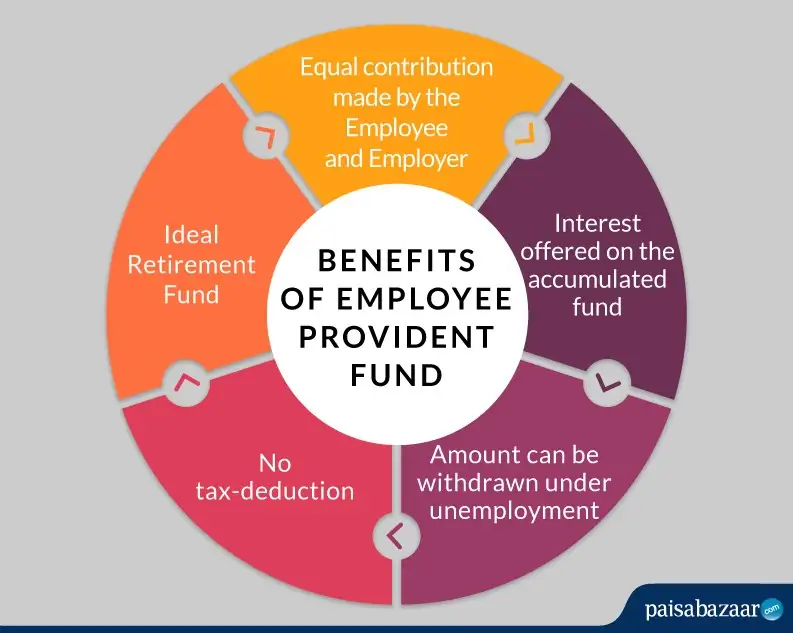

PART II THE BOARD AND THE INVESTMENT PANEL. The EPF corpus can be withdrawn if a person faces unemployment before retirement due to lock-down or retrenchment. For late payments of accelerated tax self-assessment tax standard tax TDS TCS equalization fee STT CTT there is a lowered.

What happens if you miss the return filing deadline. 15th June 2012 as increased by grace period of 5 days. Also consider the case in which you deposit tax one month after the due date.

Then the due date is 7th March 2022. When withdrawals are made in 2022 they are eligible to receive withdrawal payments together with dividends at the rate of 2021 for the period of the savings are in. The last date of filing belated ITR is December.

Cancelling PF claim request. Establishment of the Board. Finance Ministry TDSTCS Updates Due to Covid19.

An employer has to pay the EPF contribution to the EPFO every month. PF payment due date. A late fee of Rs.

The date of exit of the employee must be updated in the UAN member portal. Say you have deducted TDS on 21st February 2022. If you have missed the deadline of filing income tax return ITR for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR.

This has to be done on or before the 15th of next month. Thus if wages pertaining to April 2012 is paid on say 7th May 2012 due date for payment of Provident Fund contribution is 20th June 2012 ie. Name of the Payee.

5000 under Section 234F will need to be paid. The details on the EPF joint declaration are as follows. 25 lakh to be taxed.

The property for which you are making the payment must be in your name your spouses name or jointly held by both of you. Budget 2021 EPF contributions of more than Rs. Once the payment process is completed you will receive the system generated ESI Registration Letter known as C-11 to your registered email ID.

Members who plan to make full withdrawal in any category after the crediting of 2021 dividend the 2021 dividend will be credited into their account on the dividend crediting date. EPF members can claim 75 of their PF amount after 1 month from the date of leaving and the remaining 25 can claim after 2 months. The EPF subscriber has to declare unemployment in order to withdraw the EPF amount.

The interest is calculated from the date on which TDS was deducted and not from the date TDS was due. So as to claim the process. According to the amended income tax law if employers fail to make timely deposits of EPF dues they will not be eligible for the deduction employers may claim a tax deduction on the EPF contribution deposited as an.

The Central Provident Fund Board CPFB commonly known as the CPF Board or simply the Central Provident Fund CPF is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement healthcare and housing needs in Singapore. Verify all of that like DOB EPF and date of joining etc. Last Date for registration under Atmanirbhar Bharat Rozgar Yojana ABRY is 31032022.

Select Wage Month Salary Disbursal Date and Rate of Contribution and upload the ECR. On successful payment PaymentTransaction-id will be generated and e-Receipt for transaction confirmation will be populated. Please register yourself to avail the benefitsClick here for details.

Details of payment on which tax has been deducted but has not been paid on or before the due date specified in sub-section 1 of Section 139. Your fathers name and also the date of exit. The users should exercise due caution andor seek independent advice before they make any decision or take any action on the basis of.

No last date is declared by EPFO for filing nomination. Premature withdrawal from EPF. Important list of banks that provide online EPF payment services.

The confirmation of payment against TRRN number will be provided by EPFO. PF has two due dates they are payment due date and the ECR filing due date. Employers will also receive an SMS for non-payment of EPF.

Once you verify go to Step 1. Subscribers are now awaiting the payment of interest on their PF accounts from Employees Provident Fund Organisation EPFO. Further to promote the timely payment of ESI and PF to employees accounts the income tax act also provides for disallowance of PF and ESI deposited after the due date.

Accordingly employers shall not get the deduction of EPF or ESI deposited after the due date under Income tax and they will end up paying income tax on it. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. The employer has to pay the EPF contribution within 15 days of the next month.

Benefits of Buying Health Insurance Policy. If you deposit tax on 8th March 2022 ie. It is important to note that missing the TDS return filing due date has monetary consequences.

However an individual is required to pay a late filing fee if heshe is filing belated ITR. Due date for payment of Provident Fund contributions is 15 days from the end of month in which wages are paid plus grace period of 5 days. Date of Payment.

Late Payment Penalty in EPF. Upon the late payment of EPF. The Aadhar and bank account details must be linked and digitally approved by the employer.

One day after the due date. The CPF is an employment-based savings scheme with the help. Also the UAN update of Date of leaving with appropriate reason is a must for.

Steps for PF online payment on the EPFO portal. Due to the KYC mismatch the interest payment of approximately 40 lakh subscribers for the financial year 2019-20 was delayed. However the due date of PF return and the due date of PF payment are both the same ie.

Ie if you want to deposit PF contribution for the month of June then it has to be. This is the date by which you have to submit the PF which you will deduct from your employees salary. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning.

Fathers Name or Husbands Name. The C-11 acts as proof of registration of the company with the ESIC. The government amended the income tax law in Budget 2021 to ensure that employers deposited the employees EPF dues on time.

The due payment of 55000 employees of the North Delhi Municipal Corporation will be made under the National Pension Scheme and Provident Fund. On or before the 15th of every month. The transaction will be updated at EPFO Portal.

Epf Registration Online Process For Employer Social Security Benefits Registration Employment

How To Report Epf And Esi Due Date Extension In Tax Audit Report For Ay 2020 21

How To Withdraw Pf Without Date Of Exit Yes It Is Possible

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epfo Subscribers Get More Time To Complete E Nomination Process Details Here

Epf Withdrawals New Rules Provisions Related To Tds

How To Correct Wrong Date Of Exit In Epf Pf Date Of Exit And Date Of Joining Update Epfo Detail Youtube

Pf Payment Due Dates For Fy 2019 20 For Tax Audit Reporting

A Complete Guide On Process For Epf Withdrawal Online Claim Ebizfiling

Govt Extends Due Date To File Pf Contribution Returns For The Month Of March 2020

Relief To Establishments From Levy Of Penal Damages For Delay In Deposit Of Epf During Lockdown

How To Update Epf Date Of Exit Online Without Employer Basunivesh

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Relyonsoft Pf Due Date Grace Period For Deposits Is Now Removed

Due Dates Relating To Payroll India Esi Pt Pf Tds

Epf Payment Online Procedure Receipt Download Late Payment Penalty

How To Update Epf Date Of Exit Online Without Employer Basunivesh

Deadline For Epf Aadhar Linking Step By Step Guide To Link Uan To Uidai

Pf Online Payment Process To Make Epf Online Payment

- rambut rontok obat alami

- us currency to rm

- beg tangan dari seluar jeans

- cat bilik tidur warna hitam

- jual beli perabot terpakai ampang

- gambar gambar bunga ros

- undefined

- epf payment due date

- desain ruang tamu ukuran 3x3

- kata kata bijak perawat

- resepi terung tempura

- harga lexus di malaysia

- potongan harga di tix id

- harga ban bridgestone ecopia

- surat perjanjian rumah sewa

- new honda hrv malaysia 2019

- acknowledgement example for research paper

- karangan kepentingan menjaga kesihatan

- agama agama di malaysia

- nissan serena vs toyota voxy